Projections for 2017 and beyond by STR, CBRE and PKF all call for anemic occupancy growth at best, notwithstanding record occupancy levels for the U.S. hospitality industry. With Revenue Per Available Room (RevPAR) growth projections at inflationary levels (2.5 – 3.5 percent, or so), it is clear that expectations call for Average Daily Rate (ADR) growth to continue, but will it?

Coal miners used canaries to warn them of lethal gasses they couldn’t smell, see or taste. And, while we can’t rely on canaries to help us stay out of trouble as hospitality operators, we may be able to rely on history. It is oft-quoted tenet that history is the best teacher and, if that is true, then we’d be well served to reflect on what we can learn from our past.

The Good

- Sector Resilience – The hospitality sector as a whole is resilient. It employs lots of smart, dedicated and hard-working individuals. However, it is not immune to external shocks-and recovery can take considerable time. Renata Kosova and Cathy Enz published an excellent article (Cornell Hospitality Quarterly – September 2012) that examined the impact and industry response to two major external shocks from the previous decade (the terrorist attacks of September 11, 2001 and the financial crisis of September 2008). Their study concluded that hotel management didn’t fall into disarray, but successfully addressed the effects of these events as evidenced by hotels’ eventual recovery.

- Cyclical Demand – If the past several decades are any indication, it is clear that demand in the hospitality industry is cyclical. As such, it has required hospitality executives to adapt to ever-changing conditions.

While factors that contribute to demand (or lack there of) for a specific property or market are vast, we can point to some common measures that serve as indicators for overall health of the hospitality industry-absent any readily identifiable external shocks. Gross Domestic Product (GDP) movement historically has had the strongest correlation to changes in RevPAR. The challenge is that GDP movement is a coincident indicator and not a leading indicator, so this puts a premium on the need for operators to make appropriate decisions in real-time. Employment levels and personal income (both contributing to overall consumer confidence), plus corporate profits are admittedly lagging indicators, but are useful in providing some degree of guidance as to what GDP performance may look like in the months ahead.

Unfortunately, the stock market, which is usually a clear leading indicator, is unreliable-particularly when it comes to investment behavior surrounding hospitality stocks, as there historically hasn’t been a strong correlation between stock price movements and actual sector performance. The silver lining in all this is that, according to the pundits, U.S. GDP is projected to continue to grow in 2017, albeit at a lackluster pace just shy of 2 percent.

The Bad

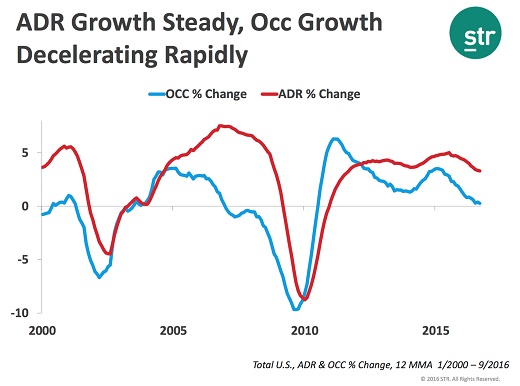

- Disproportionate Responses in ADR – When a trend indicating a change in demand is ultimately recognized by those in the industry, ADR will typically (not always) move in the same direction, but ADR will always lag changes in demand-sometimes by several months. The chart from STR, Inc. illustrates this point nicely.

To simplify the reasons behind this phenomenon, we can point to booking lead times associated group and wholesale contracts, plus annually negotiated corporate rate programs, as examples. When this on-the-books demand “burns off”, it is replaced by new demand, which books at the then prevailing market levels.

More alarming is that in the past three major downturns, ADR drops have deepened and recovery times back to previous peaks have been protracted. Factors contributing to this increasing amplitude include: mix of new supply (more midscale and limited lodging entering the market prior to the most recent downturn for example), distribution costs (i.e. mix of sales relating to increased reliance on OTA merchant models, opaque and flash sale models), increased consumer-facing pricing transparency and emphasis on strong year-over-year occupancy performance expectations.

The Ugly

The Dumbest Competitor in the Room – Also contributing to exaggerated ADR declines in the face of declining occupancy (or perhaps even the prospect of softening occupancy growth) would be flawed yield automation, that accelerates mindless and non-strategic pricing action based on changes within competitors pricing. Similarly, inappropriate unilateral pricing reactions by a given competitor, even in a highly fragmented marketplace, are also concerning, as the effects within a competitive set can be dramatic.

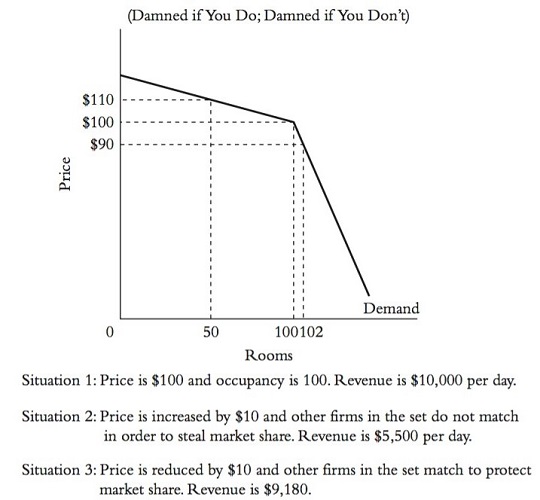

I recently spoke with Dr. Bill Carroll at Cornell University in Ithaca NY who explains how the “game theory of competitive sets” predicts that firms will lower price in the face of projected occupancy downturns. Supporting this premise is research using STR data (Hanson 2005) -the price elasticity of competitors within a competitive set is elastic (E = 1.1) but that collective elasticity of a set is inelastic (E = 0.3). See figure below:

This supports the notion that a competitor not lowering price when the majority of others within a set do, stands to lose substantial market share and therefore revenue. It also suggests that all competitors within the set will collectively lose more revenue by lowering rate in response to occupancy declines since occupancy won’t make up for the drop in rate.

This analysis may also provide a clue as to why ADR recovery following a downturn is more protracted than would ordinarily be expected in the face of strengthening demand. There is clearly a risk to a given competitor in driving rate when competing against reasonable substitutes who don’t follow suit.

The Psychology of Competitive Pricing

ADR is a common industry metric that is often (but incorrectly) used interchangeably with pricing. In reality, reported ADR at an individual property level is composed of a myriad of pricing inputs, policies, inventory controls, unit type composition, customer segmentation and channel mix of sales, for example. While it doesn’t tell the whole story, aggregated ADR data for a given market or set is readily available, so, all things held equal, serves as a reasonable surrogate for relative pricing actions in most studies.

In a quest to better understand the psychology of competitive pricing behavior at the channel and segment level, we turn to Peter Starks , President and CEO of REDGlobal and former Dean of Faculty at Hague Hotel School in the Netherlands. Through Peter’s REDGlobal software simulations, participants (acting as competing hotels) consistently and statistically, follow one another by dropping price when occupancy is anticipated to drop and collectively lose more revenue than they would have otherwise. This means that even at the channel and customer segment level, the results relating to competitive behavior mirror what studies have observed at the aggregated ADR level.

The Canary is Dead. Now What?

There are several actions you can, and should, take now for the long-term health of your operation and to avoid having to participate in “the race to the bottom” from a pricing standpoint. Some of them are listed below:

Know Your Value

Not only is it important to understand who your guests are: where they come from, how they book, what they spend their money on while at the property, etc.; but also their motivation. Why are they traveling and why have they selected to stay at your particular property? Are they truly loyal guests or are they likely to seek alternatives? If it is the latter, do you know why? By answering these questions, you will be in a much better position to understand the value you represent to your guests and where your vulnerabilities lie.

What’s the easiest way to accomplish this? Engage in dialogue with your guests. Your front line staff does this naturally anyway. Listen to their insights.

Know Your Competitors

Not every property in your area should be considered a direct competitor. Only once you have a clear picture of the types of guests you cater to and when, can you reasonably ascertain whether a particular property would be a reasonable substitute. It is also important to consider conditions in which this would be true or not true. For example, a slope-side property in a ski destination may be a viable competitor in winter, but could be geographically undesirable during other times of the year, so should not be considered a true competitor during those times.

Much fuss is also being made of so-called “alternative accommodations” in certain markets. If the value proposition associated with these accommodations directly compete with your offering, that is one thing, but don’t automatically assume that all new forms of supply are direct competition.

Focus on Differentiation

Focus on your meaningful differentiators in order to shore up demand. Emphasize what you have to offer in your marketing collateral, on your proprietary website and in your service delivery.

For example, I recently stayed at a property whereby the associates were trained to anticipate what guests might need and then go about delivering a surprising and delightful experience. At turndown, the room attendant noticed that I was traveling with quite a few pieces of electronic equipment, so she left behind lens cloths one evening. At the restaurant the next night, I mentioned in passing to a waiter that I had chapped lips and when I returned to my room, lip balm was sitting on my nightstand. The property itself wasn’t particularly grand, but these personal touches made it memorable and has motivated me to relay my experience to audiences around the world.

Past Guest Relationships

It is critical to communicate in meaningful ways with past guests. Demonstrating that you appreciate their patronage and keeping them informed about things that are happening at the property to make their stay even better the next time will go a long way. Unlike other types of purchases, people tend to have a personal connection to their favorite properties. After all, the service you provide as an operator goes beyond merely providing accommodations-you are adding to their memories and contributing to their life experience.

People also appreciate having access to things that others may not. Unique offers tailored to select past guests to illustrate your appreciation will go a long way. Just be sensitive to the frequency of these communications as list fatigue is something that you’ll want to avoid.

Respond, Don’t React

While it is true that not taking action in certain instances is the same thing as taking action, immediately reacting to the pricing actions of a given competitor in your set is the same as them having control over your pricing strategy. This is true whether you are in a manual or automated environment.

Instead, make adjustments to competitive pricing trends on your own terms and within your own time frame. It may be helpful to create a weighted average of your competitors’ publicly available pricing based on the relative impact each competitor may have on your property if they were to change rate-either up or down. The result is a composite reference rate that you can track over time to better gauge the overall demand trends (and pricing for available supply) influencing your marketplace.

A/B Testing and Analysis

When faced with ambiguity relating to your pricing strategy, it’s time to do some testing. To understand the impact of a given course of action, pick two periods of time that, in the absence of outside influences, should behave similarly.

Perhaps the 3rd and 4th week in July would be a good example. During one period adopt one course of action and during the other week do something that is distinctly different. In advance, you will want to define the key performance indicators that will allow you to draw definite conclusions. These may include reservation call volume, conversion, RevPAR by day, ADR or effect on competitors, for example. Then, have patience, it may take a fair amount of time for a strategy to take effect.

Roughly translated, the Scottish poet Robert Burns once wrote, “The best-laid plans of mice and men often go awry”. For us in the hospitality industry, this means that while history can be instructional, the coming months and years will undoubtedly test us in new ways.

Despite optimistic projections, ADR growth is not a given, and as we have explored together, may prove to be quite difficult in certain markets. Taking time now to lay a foundation that will sustain your operation through challenging times ahead is worth the effort. Just like the warning from the canary in the coal mine, now is a good time to take action.