Pricing for any type of product or service, let alone lodging, is nothing new. Any “Marketing 101” textbook will tell you that Price along with Product, Place and Promotion make up the “4-P’s of the marketing mix.” Pricing too has been in place far longer than the practice of Revenue Management, which, among many other things, incorporates pricing into its purview. What is new, and what we will explore here, are some emerging trends relating to pricing that every lodging operator needs to understand.

Most key stakeholders in a property, presumably all with good intentions, have strong opinions relating to pricing. These opinions often result from past experience and from a personal value framework. In addition, they may be influenced by business performance pressures and competitive actions, so it is understandable why pricing and pricing strategy have become the central topics at most revenue strategy meetings.

Before we get into emerging pricing trends and where we are headed as an industry, it will be helpful to get a historical perspective on how we arrived at where we are today. It should also be noted that sophistication levels related to pricing vary greatly from property to property, so it is common to find properties operating at each end of the spectrum, and points in between.

Level 1: Rack Rate

Prior to the age of technology adoption, it was very common for most (if not all) lodging establishments to have a key rack behind the front desk that acted as both storage for room keys and as a primitive inventory control system. The established price for each room, along with other basic information about the room, such as bedding configuration, room status etc. was affixed to a card that was located in each key slot. For “walk-in” (or “walk-up” guests as they were called back then), a desk clerk would select a room and pull the card from the rack in order to quote the correct room rate to the guest.

Some clerks would pull a few cards and “pocket” them at the start of their shift in anticipation of saving these rooms for their most valued guests. Of course, these same clerks may also have been given the authority by management to depart from the established rack rate under certain circumstances, but needed to account for all rooms and rates at the end of their shift by recording them in some form of ledger. A guest ledger was common for most registered guests and a city ledger was used to record an accounts receivable for regular guests or local companies.

With the advent of technology, perhaps most notably the NCR4200 posting machine, which revolutionized guest accounting and departmental billing capabilities (heaven forbid if you ever forgot to put a folio back in the “bucket” after posting room or other charges and lost it—a personal story, but I digress), combined with the ability to market the property by publishing room rates on a brochure, the term “rack rate” was replaced by the term “published rate.” Today however, both terms are used interchangeably.

It is not too common to see a property publish its fixed, yearlong price for each room type in a brochure card any longer, but some still do.

Level 2: Variable Pricing

Innkeepers began to recognize that seasonal and day-of-week occupancy patterns meant that demand for sleeping rooms was variable throughout the year and that having an annual published rack rate wasn’t a very effective way to go about maximizing occupancy. Remember, back then with fixed rack pricing in place, growing occupancy was the primary way to grow the business from one year to the next. So, hoteliers began to think through how their pricing could flex to better match known demand patterns.

Brochures began to reflect seasonal rates and even midweek vs. weekend rates for each room type. Some more sophisticated pricing schemes also reflected increases or decreases in premiums between room types by season and/or day of week. A concept we refer to as “rate granularity” today. While not published, policies on what types of discounts to offer certain guests were also formalized. This was the start of customer segmentation and what revenue managers of today call “fencing.”

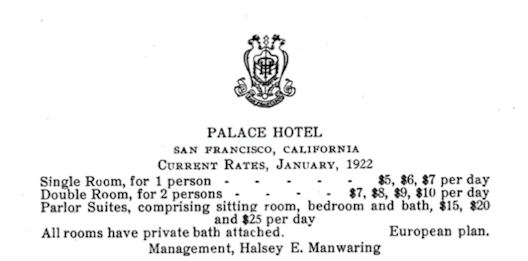

Variable Pricing in the year 1922 from the Palace Hotel in San Francisco

Level 3: Dynamic Pricing

About a decade following the era of US airline deregulation in 1978, Revenue Management was a nascent discipline within the hospitality industry and not widely adopted by those other than the major chains. The concept of establishing multiple price points for different customer segments AND having many of those price points move fluidly based on forecasted daily demand provided hotel operators the opportunity to drive additional profit. It also mandated an additional level of sophistication, hence reinforcing the need for revenue management professionals to be employed in order to keep an eye on things.

The two primary methods for managing rates in this environment required either the creation of a rate matrix or the ability to create a relationship between a parent rate (published rate) and child rates (derived rate plans). In the former method, certain rate tiers were made unavailable for any given arrival and length of stay combination, leaving others available for sale. In the latter case, the price of the parent rate was changed and the child rates “floated” up or down accordingly. A hybrid was also developed with the latter configuration, whereby a “hurdle” value was introduced for each day and rate plan—regardless of whether or not it was a parent rate or a child rate—and was made available only if the stay value was above the aggregate hurdle value for any arrival and length of stay combination. Of course, in either scenario, certain rate plans were exempt from yield controls.

In the mid-1990’s, online travel agencies (OTA’s) such as Expedia, Travelocity and Priceline, emerged. Originally thought of by revenue management practitioners as discreet channels to capture incremental demand by offering room discounts to a small number of computer “geeks” and other early adopters, OTA’s popularity among mainstream travelers gained momentum astonishingly quickly.

Originally retail-only distributors, many OTA’s had adopted a merchant model by the late 1990’s and early 2000’s and were unencumbered by the constraints that controlled wholesalers for years such as inventory risk, pre-payment and the requirement to bundle net rates with other components such as airline tickets. As a consequence, these new intermediaries were provided with a structural advantage. Hotels responded by wrestling back control mainly by introducing best rate guarantees, but in order for these guarantees to work, retail rate parity clauses needed to be put into place – along the lines of the most favored nation clauses that had been in place for years prior with travel agency consortia hotel programs.

While dynamic pricing promised additional profitability for hoteliers, transparency into competitive pricing actions through online channels and through rate shopping subscriptions, combined with increasing costs of distribution and an already fragmented industry facing additional competition, meant that negative shifts in demand triggered a disproportionate reaction in average daily rate (ADR*). Unfortunately for the industry, and as a boon for travelers, there is also a measurable ADR lag that has historically occurred during periods of recovery.

*Note: While ADR, is an output resulting from numerous factors such as channel, room type and segmentation mix, that isn’t directly related to only pricing decisions (which is just one input factor of many), it is the most accessible industry metric from which to judge relative positioning and property rate performance trends over time.

Level 4: Target Pricing

Before we explore the concept of target pricing, let’s examine what a price really consists of for a hotel room. It goes beyond a simple amount that the guest pays to include four (4) primary elements:

- A unit or room category

- A rate type

- A condition

- A value

A unit type or category is straightforward enough. It may mean a standard guest room or a suite at a typical hotel property, or it could include a cabin, 2-bedroom oceanfront villa or a specific size yacht, in other applications of the term. A rate type could be a BAR rate, AAA rate, Negotiated rate or multitude of other rate plans made available for sale. A condition could mean all sorts of things, from how far in advance the reservation is being made, the length of stay associated with the reservation to policies that differ from other rate types, or even on individual guest qualifications such as affiliations or loyalty levels. Several conditions, rate types and unit types can be combined into a “product” which is then offered for sale. The price associated with these products and how they are distributed, to whom and when, are all decisions that properties need to consider…. and it is clearly properties that dictate their own pricing for their products and services. This is in stark contrast to what some well-meaning regulators, attorneys and others unfamiliar with the inner workings of how pricing works in the hospitality industry may attest.

Rate parity, as we know it, is being challenged as of the writing of this article and while we won’t debate the merits or shortfalls of rate parity here, one thing is clear, the world of distribution may look quite different by the time this article is published, or perhaps shortly thereafter. Properties will be forced to think very carefully about how to craft and distribute their pricing strategies. Dynamic pricing just won’t cut it.

Given the complexity associated with establishing pricing, to begin with, and the need to operate in a changing distribution landscape, one can imagine that there may be a desire on the part of some hotel operators to simplify everything and revert to variable pricing. But, that would be doing both consumers and themselves a disservice. Instead, conditions will be ripe for target pricing to come into its own, and there is a necessity for this to happen for the health of the industry prior to the next downturn.

Target pricing consists of offering a price to a given guest segment based on the value of this segment to the property. This means that properties will need to assess such things as cost of acquisition, ancillary outlet spend propensity, segment price elasticity, stay pattern, loyalty, lifetime value and perhaps, even social media risk, for example.

For this to work effectively, properties will likely need to become more selective with the numbers and types of distribution channels and other partners they work with today. A distribution channel, wholesaler or other partner that assists a property in reaching a segment that they can’t reach efficiently on their own will be rewarded. This may foster additional opportunities for niche players (hotel suppliers and distributors included), but they will need to deliver on their value proposition to remain viable.

Properties will also need to understand the contribution to profit that various guest segments represent. They will need to track and assimilate a great deal of internal and external data to ascertain unconstrained demand potential and to then selectively adjust the availability of prices through all points of distribution, including property-direct in order to optimize property performance. It will require communication and coordination between revenue management practitioners and those in Accounting, IT, digital marketing, social media management, sales and traditional marketing roles.

Due to the inherent need to track relevant data and selectively administer pricing through discrete channels of distribution, we are only now about to enter a phase whereby the concept of target pricing can be effectively implemented. If this sounds a bit daunting, it is, from where we sit today. But we’ll adapt, as we have always done in the past, by deploying new technologies and new techniques… and revenue management practitioners will need to invest time in getting up to speed in order to compete effectively in this brave new pricing world. Better fasten your seatbelts.